Professional CFO Services For Small Business Owners.

Let me handle the numbers so you can focus on growth.

Are you a 6-7+ figure entrepreneur who needs help managing your finances?

It’s simple: your business has reached a level of success that’s grown beyond the capabilities of a single person to handle. Stop holding yourself back by operating outside your zone of genius.

Allow me to manage your cash flow and systemize your financial processes.

I’m Aaron Pierpoint. With over 10 years of experience as a virtual CFO, I’ve created a simple method that goes beyond basic bookkeeping to help business owners better understand their finances and leverage their money for growth.

Here’s how it works

I will build and manage a customized financial system for your small business that’s proven to work in less than 90 days.

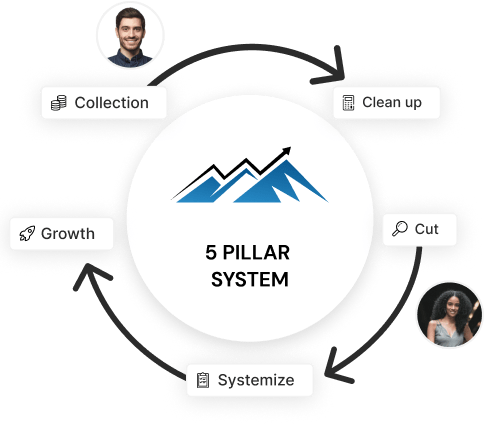

The 5 Pillar System:

Step 1 - Secure your money

If there’s money to be collected, I'll find it and bring it in. In this step alone, I've been able to recover tens of thousands of dollars per month for my clients.

Step 2 - Clean up the books

I’ll work with your CPA to make sure that your books are caught up and current. From there, I create a customized and automated system for you that organizes cash flow.

Step 3 - Cut the fat

Here's where I audit your business to make sure your money is stretching as far as it can go. Based on this audit, I'll make recommendations about pricing, cutting expenses, tax-advantageous investments, growth opportunities and so forth.

Step 4 - Systems, systems, systems

Now I'm ready to streamline every step of your business' financial processes--from billing customers, to administering payroll, to making investments and purchases, to presenting financials. I'll make sure that you have the most up-to-date tech and software that has your business operating smoothly

Step 5 - Growth

This is the fun part. We get to create a plan to use your money to help you reach your business and personal money goals. I’ll provide ongoing support and management along the way.

Sound like a plan?

Here’s what some of my clients have to say:

“Working with Aaron has been a game-changer for our multiple 7-figure lawn mowing and landscaping business. He’s helped me get my time back by creating systems to manage all aspects of the finances in my business. This allowed for a more strategic approach to growth and resulted in 25% in the first year. Beyond the finances, Aaron is also an operational ally, offering invaluable insights and recommendations that have enhanced our day-to-day efficiency.” – Austin

“When I first hired Aaron, my business was a mess. I hadn’t had the time to keep up on the finances and everything needed to be cleaned up. He helped me get back on track and create the systems and processes needed for me to grow into the next level of business. Aaron isn’t like a lot of accountants who are poor communicators and too busy to give you time and attention. We talk weekly and he’s always available to run things by.” – Sean

“I brought Aaron in because I have multiple businesses which made tracking difficult to stay on top of. He was able to streamline everything into one place with systems and

spreadsheets to easily see where everything is at.” – Renee

If you're tired of:

Worrying about cash flow

Spending time on financial and administrative tasks when you could be focusing on money making activities

Dealing with client payment issues

Rushing around during tax season getting everything together last minute

If you’re ready to:

Know your numbers so you can properly forecast

Rest easy knowing that all your financial processes are systemized and operating smoothly

Know exactly what you’re paying for and where your money is going

Make decisions based on data and numbers rather than hopes and feelings

Get free from the weeds of tracking financial tasks

Stop worrying about where your money is going each month

Know that sales will be collected each month

Then schedule a call and let’s talk

As your fractional CFO, I will:

Work with your CPA to make sure you’re making the best decisions for tax purposes throughout the year

Analyze and make recommendations for product pricing to stay profitable

Analyze strengths and weaknesses to propose corrective action plans when necessary

Prepare accurate forecasts so that management can make informed decisions about future investments or cuts

Create cash flow forecasts to know exactly where you’re at to aid in future investment decisions or large purchases

Create a budget to forecast the future while analyzing your year-to-date performance

Build custom dashboards and weekly reports that provide a clear picture of your financial state at any time

Reconcile accounts and produce financial statements on a monthly basis to stay informed on your current performance

Keep you up to date on the current systems and software to easily share and record data

Audit internal controls and processes to improve all how information flows across the company

Manage accounts payable and accounts receivable to ensure money is paid and received on time each month

Provide done-for-you tax preparation for easy hand-off to your CPA at the end of the year